Enjoy High Yields (and Low Risk) with a Term Savings Account

Earn up to 5.35% APY* today.

Boost your savings with a Quorum Term Savings Account (similar to CDs). Lock in a high-yield rate without worrying about how market changes may affect your rate (because they won’t).

.png)

Choose the Terms and Rates That Are Good For You

Like bank CDs (Certificate of Deposits), term savings accounts or share certificates are low-risk accounts that provide you with the opportunity to earn higher interest rates over a specific duration and allows you to watch your money grow at a steady rate.

PRO SAVER TIP: To earn even more in interest, open any of our term accounts (share certificates) with at least $100,000 and you'll earn an additional 0.10% APY on your savings.

7 MONTHS

5.25% APY* (5.13% APR)

**NEW MONEY ONLY. Minimum balance to open and earn APY: $1,000. Earn 5.35% APY (5.22% APR) for balances $100,000 and up.

15 MONTHS

5.00% APY* (4.89% APR)

Minimum balance to open and earn APY: $1,000.00. Earn 5.10% APY (4.98% APR) for balances $100,000 and up.

High-Yield and Stable

Lock in High-Yield Rates

Our Term Savings Accounts or Share Certificates (similar to CDs) can help you reach your financial goals and maximize your earnings with high-yield, fixed rates. The best part is, once you open one of our term accounts, all you have to do is sit back, relax, and watch your money grow.

Your money will earn a steady APY and you won't have to worry about your rate changing during the course of your term, no matter what happens in the market. You can open as many accounts as you want, so you don't have to choose between short- or long-term options. You can do both!

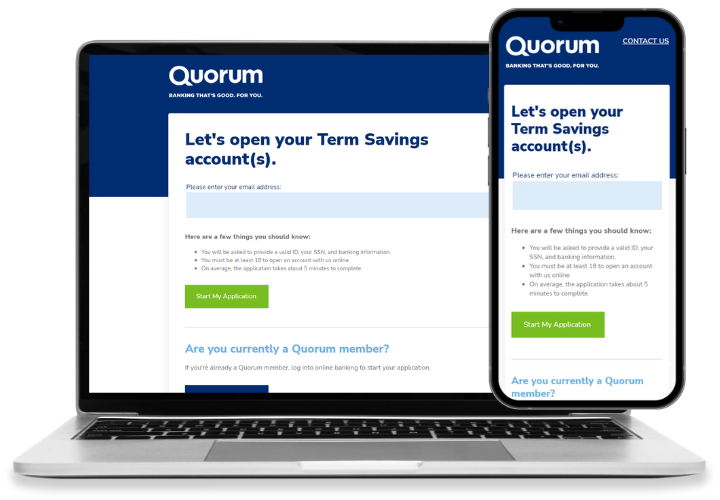

Quick and Easy Online Application

Open an Account in Under 5 Minutes

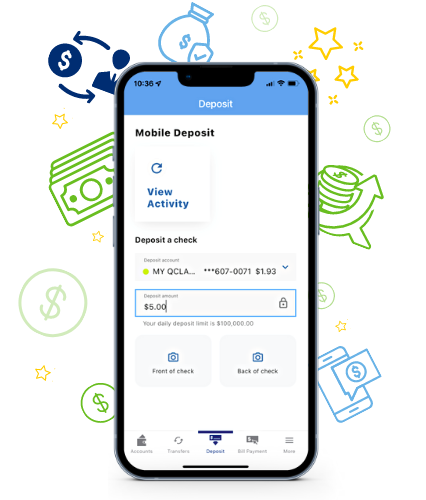

Mobile Banking

Manage your account anytime, anywhere with our highly rated mobile app.

Unlock the power of your mobile device with our mobile banking app. Seamlessly bringing the convenience and reliability of an online credit union right to your fingertips, you can bank on the go, 24/7.

In addition to managing your account online, transferring funds with ease, and conveniently depositing checks through your mobile device, our app also lets you safely send money to anyone across the US with just a few taps using Zelle®.

"This app is so fantastic! It makes deposits so easy as I don't have to find a storefront location anymore; I can deposit in seconds. All my banking information is a touch away. Absolutely love this app." Ictaub, Quorum Member, iOS User

"Best customer service; user-friendly website. Love the ease of transferring funds, paying bills, downloading statements. And mobile deposits—never had a problem." Cwooder, Quorum Member, iOS User

"Having a powerful banking app like this is essential because of my remote location. There is very little that I cannot accomplish with this banking app!" Ted H., Quorum Member, Android User

"A very well-designed and smooth-running app. I very rarely have issues with it and any problems are fixed quickly. It's easy to access all my accounts and I do everything I need to do right from the app." Quorum Member, Google User

Why Bank with Quorum?

Named One of the Best Credit Unions of 2024 by Bankrate

Over 65,000 Members Continue to Choose Quorum

By opening a Quorum Term Savings account, you not only gain access to incredible savings rates, you also become a valued Quorum member. This membership is your key to top-of-market personal banking products that are only available to members. You don't have to do anything extra. Once you open your term account, you automatically become a Quorum member!

Why should you choose Quorum? For starters, we're not your typical bank. As a member-owned, online credit union, we prioritize you (our member) over stockholders. We believe in giving back to you. We distribute our profits through high interest rates on savings products and low interest rates on loans. As an online credit union, we also have lower overhead costs, allowing us to provide a seamless online banking experience, along with top-notch customer service.

We are Quorum. Banking That's Good. For You.™